Blogs

“Third-Party Posts”

Estate Planning & You: Getting Ready for 2026 (Without Freaking Out)

state planning sounds like something for billionaires in marble mansions… not for regular people with a mortgage, a 401(k), a dog, and a favorite taco spot. But here’s...

Retirement Planning in 2026: How to Prepare for a New Era of Retirement

If you feel like retirement has gotten more complicated, you’re not imagining things. Between market volatility, rising costs, new tax rules, and longer life...

Retirement Planning in 2026: A Practical Playbook (and How Annuities Can Help)

TL;DR: Going into 2026, retirees face two big realities: markets that still swing and a shifting tax landscape. Focus on dependable income, flexible tax buckets, and a...

Retirement Planning Heading Into 2026: 7 Smart Moves For Clients Right Now

As 2025 winds down, retirement planning is shifting under three big spotlights: taxes in 2026, retirement plan rule updates, and Medicare drug-cost changes. Here’s a...

Annuities 101: Why They’re (Sometimes) a Great Idea for Retirement

Quick Take Annuities are insurance contracts that can turn a portion of your savings into guaranteed income you can’t outlive. For the right person, they lower stress,...

Retirement Income Planning: A Practical Guide for Turning Savings Into a Sustainable Paycheck

Key Takeaways (TL;DR) Retirement success is less about “the number” and more about cash-flow durability, tax efficiency, and risk control. A resilient plan blends...

Integrating Life Insurance & Fixed Indexed Annuities: A Smarter Way to Protect, Grow, and Distribute Retirement Wealth

Big idea: Life insurance and fixed indexed annuities (FIAs) aren’t either/or. Used together, they can help protect income, manage taxes, and transfer wealth more...

Why Fixed Indexed Annuities Are a Smart Choice for Retirement Planning

When planning for retirement, one of the greatest challenges is balancing growth potential with protection of principal. Many investors seek opportunities that allow...

How much can you spend without running out of money? The 4% rule is a popular rule of thumb, but you can do better. Here are guidelines for finding your personalized...

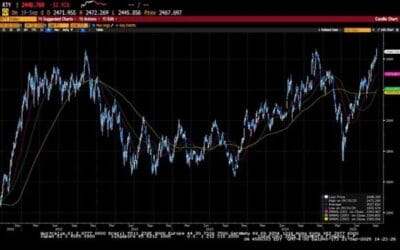

Weekly Market Commentary

Apprehensive investors pushed markets higher this week, with the small-cap Russell 2000 hitting a new all-time high, while the S&P 500 closed just 50 points below...

Weekly Market Commentary

The holiday-shortened week saw global financial markets trade higher. Increased optimism for a December rate cut, along with some constructive news on the AI front,...

Weekly Market Commentary

Financial markets continued to decline as investors sold AI-related stocks amid valuation concerns, while rotating into more defensive sectors such as healthcare and...

Weekly Market Commentary

Markets were choppy and ended the week with mixed results. Investors poured into risk assets on the idea that the longest US government shutdown was over, but a more...

Weekly Market Commentary

Well, the market finally had a significant pullback, but not before the S&P 500 and NASDAQ were able to set another all-time high. The week began with a deal...

Weekly Market Commentary

Investors sent US markets to another set of all-time highs despite concerns about an extended government shutdown. The U.S. government shutdown was largely dismissed...

Weekly Market Commentary

The S&P 500 hit a 28th record high for the year before settling lower for the week. Investors endured a choppy week of trading as better-than-expected economic data...

Weekly Market Commentary

The major US equity market indices forged another set of all-time highs as investors went all in on risk assets after the Federal Reserve announced a twenty-five basis...

Weekly Market Commentary

US equity indices posted another set of all-time highs as investors increased expectations for three, twenty-five basis point rate cuts by year's end. Inflation data...

Ed Slott’s Elite IRA Advisor Group (Ed Slott Group) is a membership organization owned by Ed Slott and Company, LLC. Logos and/or trademarks are property of their respective owners and no endorsement of (Joe Cruz) or (Select Retirement Wealth) is stated or implied. Ed Slott Group and Ed Slott and Company, LLC are not affiliated with Select Retirement Wealth.

For the detailed requirements of Ed Slott’s Elite IRA Advisor Group, please visit: https://www.irahelp.com/

Best of the 2025 Slott Report

By Sarah Brenner, JD Director of Retirement Education ‘Tis the season for lists! Best TV shows, best of music and best podcasts. The lists go on and on. In the spirit...

Grinch Gifts: Penalties and Missed Opportunities

By Andy Ives, CFP®, AIF® IRA Analyst The Grinch likes it when things go horribly wrong. He likes it when rambunctious pets tip over Christmas trees. He likes it...

Holiday Cheers and Jeers

By Ian Berger, JD IRA Analyst In the spirit of the holiday season, here’s a list of cheers and jeers for the IRS and Congress: Cheers to the IRS: To its credit,...

By Sarah Brenner, JD Director of Retirement Education The holidays are here and the countdown to year’s end has started. For many retirement account owners, this means...

Qualified Charitable Distributions and Inherited IRAs: Today’s Slott Report Mailbag

By Sarah Brenner, JD Director of Retirement Education Question: If a grandchild, age 30, inherits IRA assets from her grandparent, age 92, and has to take...

The Wonderful, Magical Form 5498

By Andy Ives, CFP®, AIF® IRA Analyst In a scene from “The Simpsons,” daughter Lisa announces she has become a vegetarian. Homer asks some probing questions. “Are...

IRS Addresses Unanswered Questions About Trump Accounts

Ian Berger, JD IRA Analyst As is often the case with new legislation, the One Big Beautiful Bill Act (OBBBA) left unanswered a number of questions about Trump...

First-Time Required Minimum Distributions and Qualified Charitable Distributions: Today’s Slott Report Mailbag

By Andy Ives, CFP®, AIF® IRA Analyst QUESTION: My client turns age 73 in November 2026. If he takes his first required minimum distribution (RMD) in December...

New IRS Guidance on Trump Accounts Is Released

Sarah Brenner, JD Director of Retirement Education The IRS has issued guidance on Trump Accounts, which are new tax advantaged accounts for children established...