Blogs

“Third-Party Posts”

9 Ways Retirement Will Be Different in 2025

How changes in Social Security, Medicare, 401(k) contributions and more will affect your finances Retirement is not static. Even when the kids are gone and the career...

Important Tasks & Decisions for Each Phase of Retirement Planning

Important Tasks & Decisions for Each Phase of Retirement Planning Retirement. It tends to be a catch-all word that generally refers to the light at the end of the...

Retirement Challenges in 2025: Market Volatility, Inflation and Social Security

Inflation, uncertain markets and a limited Social Security COLA are among the financial hurdles for retirees in 2025. Key Takeaways High interest rates may complicate...

3 Social Security Changes Retirees Need to Know About in 2025

Key Points A modest cost-of-living adjustment (COLA) will make benefit checks bigger. Note that higher earners will pay a bit more in Social Security taxes. Retirees...

If you’re nearing retirement, these 2025 changes could affect your finances. Here’s what to know

Key Points If you’re nearing retirement, key changes for 2025 could affect your finances, according to advisors. Starting in 2025, there’s a higher 401(k) plan catch-up...

A Checklist for Retiring in 2025

Our checklist for retiring next year includes everything you need to do before the retirement party. Only you can know if you're ready for a checklist for retiring in...

Social Security’s full retirement age is increasing in 2025. Here’s what to know.

Most Americans may consider the standard retirement age to be 65, but the so-called "full retirement age" for Social Security is already older than that — and it's...

5 Key Changes to 401(k)s in 2025 and What They Mean for You

These new rules could make it easier for you to save more money for retirement Participating in a 401(k) plan where you work is a smart way to invest for retirement....

What’s Changing for Retirement in 2025?

How Secure 2.0 and inflation adjustments will affect retirement savers and spenders. For retirement savers, the ringing in of the new year will bring more than the...

Weekly Market Commentary

-Darren Leavitt, CFA Despite all of the uncertainties within the investment landscape, global markets were able to post nice gains last week. Fourth-quarter earnings...

Weekly Market Commentary

-Darren Leavitt, CFA Uncertainty about global trade continued to be at the top of investors' minds as Trump announced 25% tariffs on Mexico and Canada while levying 10%...

Weekly Market Commentary

Darren Leavitt, CFA US financial markets were extremely busy last week as a rush to download a Chinese AI platform called Deep Seek from Apple’s App Store seemingly...

Weekly Market Commentary

Darren Leavitt, CFA Wow, what a week! US markets were closed on Monday for Martin Luther King Jr. Day, and Donald Trump was inaugurated as the 47th President of the...

Weekly Market Commentary

-Darren Leavitt, CFA Financial markets advanced this week as a solid start to the fourth-quarter earnings season, and some better-than-feared inflation data gave...

Weekly Market Commentary

-Darren Leavitt, CFA US equity markets fell in the first full week of 2025 as investors recalibrated their Federal Reserve monetary policy expectations. Stronger labor...

Weekly Market Commentary

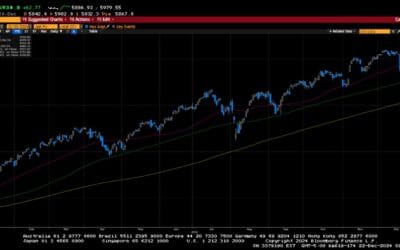

-Darren Leavitt, CFA The final trading sessions for 2024 extended losses from the prior week, but the S&P 500 and NASDAQ still posted impressive gains for the year,...

Weekly Market Commentary

-Darren Leavitt, CFA Market action was mixed in a holiday-shortened week of trade. The Santa Clause rally, which runs for the last five trading sessions of the year...

Weekly Market Commentary

-Darren Leavitt, CFA Equity and fixed-income markets sold off for the second consecutive week as the Federal Reserve delivered an expected twenty-five basis-point rate...

Ed Slott’s Elite IRA Advisor Group (Ed Slott Group) is a membership organization owned by Ed Slott and Company, LLC. Logos and/or trademarks are property of their respective owners and no endorsement of (Joe Cruz) or (Select Retirement Wealth) is stated or implied. Ed Slott Group and Ed Slott and Company, LLC are not affiliated with Select Retirement Wealth.

For the detailed requirements of Ed Slott’s Elite IRA Advisor Group, please visit: https://www.irahelp.com/

401(k) RMD Rollover Problems…and a Last-Minute Save!

By Andy Ives, CFP®, AIF® IRA Analyst 401(k) custodians are usually pretty good about distributing required minimum distributions (RMDs) from the plans they oversee....

Another Way to Lose IRA Bankruptcy Protection

By Ian Berger, JD IRA Analyst Normally, if you declare bankruptcy, your IRA funds (traditional and Roth) are completely off limits to bankruptcy creditors. But a recent...

October 15 Deadlines Are Approaching

By Sarah Brenner, JD Director of Retirement Education October is almost here. This means fall is in full swing. Along with pumpkin spice lattes, football season, and...

IRA Beneficiaries and Roth Conversions: Today’s Slott Report Mailbag

By Andy Ives, CFP®, AIF® IRA Analyst QUESTION: My father passed away in November 2021. I became disabled in April 2022. Am I now an eligible designated beneficiary...

“IRA Distribution Confusion”

By Andy Ives, CFP®, AIF® IRA Analyst Traditional and Roth IRA owners often get confused about the distributions they take from their IRAs. Mix-ups and misunderstandings...

IRS Confirms Effective Date of Mandatory Roth Catch-Up Rule

By Ian Berger, JD IRA Analyst In final regulations issued on September 15, 2025, the IRS confirmed that company retirement plans must comply with the SECURE 2.0 Act’s...

PAYMENT OF THE FIRST RMD AND THE ONCE-PER-YEAR RULE: TODAY’S SLOTT REPORT MAILBAG

By Ian Berger, JD IRA Analyst Question: Hi, If my birthday is in December 2026, when I turn 73 years old, can I take my required minimum distribution (RMD) on January...

5 Things You Need to Know About 2025 Qualified Charitable Distributions

By Andy Ives, CFP®, AIF® IRA Analyst If you are thinking about doing a qualified charitable distribution (QCD) for 2025, time is running out. The deadline is December...

Participation in Multiple Retirement Plans

By Andy Ives, CFP®, AIF® IRA Analyst Can a person who works at two different, unrelated companies participate in the retirement plan offered by each of those...